Haven't you received the income tax refund yet? Be very sure that your bank account is pre-validated...

Some important points to be noted are:

1. In come tax department has stopped the practice of sending refund through cheques. AY 2019-20 onwards, refunds are being directly transfer crediting to the bank account of the Tax Payer, which is marked as the Refund receivable bank account, at the time of ITR filing, provided that the account is linked with PAN.

2. The account should be pre-validated. If you are an online banking user and your online bank site provides option to log in for ITR filing, it is very easy to pre-validate your account, through online banking site.

How can you know the refund status?

How can you know the refund status?

1. Via the TIN NSDL Web Site

Visit https://tin.tin.nsdl.com/oltas/refundstatuslogin.html and submit the required information as given below:

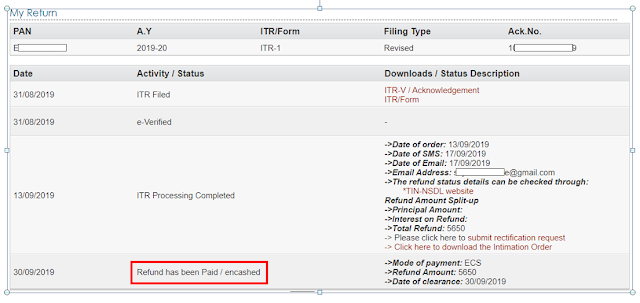

2. Via the Income Tax E-filing Web Site

Step 1 : Login the e-filing portal https://www.incometaxindiaefiling.gov.in

Step 2: View My Account > View e-Filed Returns/Forms

Step 3: Select Income Tax Return and Submit

Step4 : Select the ITR Processed- relevant Assessment Year

How to pre-validate Bank account?

Option for pre-validating your bank account is available under ‘Profile Settings’ in e-filing portal and enter details of your bank account such as bank name, account type, account number, IFSC code and mobile number linked to that bank account.

The steps to pre-validate the bank account are given below:

Step 1: Login to portalhttps://www.incometaxindiaefiling.gov.in and Go to Profile Settings Tab